Agent-commission-unit-trust-vs-life-insurance-in-malaysia,

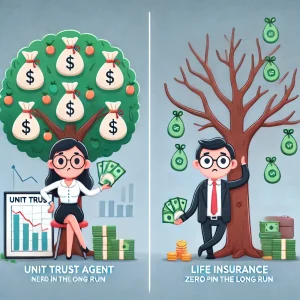

Agent Commission: Unit Trust vs Life Insurance in Malaysia. In the financial services industry in Malaysia, two of the most prominent sectors are unit trusts and life insurance. Both of these sectors offer lucrative opportunities for agents, particularly in terms of commission. However, the commission structures for unit trust and life insurance agents differ significantly, and understanding these differences is crucial for anyone considering a career in either of these fields.

Unit trusts, also known as mutual funds, are investment vehicles that pool together the funds of multiple investors to invest in a diversified portfolio of assets. The commission for unit trust agents in Malaysia is typically based on the amount of money that the agent manages to raise from investors. This commission is usually a percentage of the total funds raised, and it is paid out to the agent as soon as the funds are invested. The percentage can vary, but it generally ranges from 1% to 3%. In addition to this initial commission, unit trust agents may also receive a recurring annual commission, known as a trail commission, which is a smaller percentage of the total funds under management.

On the other hand, life insurance is a contract between an insurance company and a policyholder, in which the insurance company promises to pay a designated beneficiary a sum of money upon the death of the insured person. The commission structure for life insurance agents in Malaysia is somewhat more complex. Life insurance agents receive a percentage of the premium paid by the policyholder for the first year, which can be as high as 25%. They also receive a smaller percentage of the premium for subsequent years, typically for the duration of the policy. This is known as the renewal commission. In 7 years all the commission is 110%, depending on all the renewals of the insured.

However, it’s important to note that the commission for life insurance agents is contingent on the policyholder continuing to pay the premium. If the policyholder stops paying the premium, the agent’s commission is also affected. This is in contrast to unit trust agents, who receive their commission upfront.

While the commission rates for life insurance agents may seem higher at first glance, it’s important to consider the effort and time required to sell life insurance policies. Selling life insurance often involves a significant amount of time spent on client education and relationship building, as it is a more complex product than a unit trust. Furthermore, the market for life insurance is generally smaller than that for unit trusts, as not everyone requires or can afford life insurance.

Malaysian agent commission compare

In conclusion, the commission structures for unit trust and life insurance agents in Malaysia are quite different, reflecting the nature of the products they sell and the markets they serve. Unit trust agents typically receive a percentage of the funds they manage to raise from investors, while life insurance agents receive a percentage of the premiums paid by policyholders. Both offer rewarding opportunities, but they also come with their unique challenges. Therefore, individuals considering a career in either field should carefully consider these factors before making a decision.

Understanding the Differences: Agent Commission in Unit Trust and Life Insurance in Malaysia, the financial services industry is a vibrant and dynamic sector, with a wide array of investment options available to consumers. Among these, unit trusts and life insurance are two of the most popular choices. However, when it comes to understanding the agent commission structures for these two products, many investors find themselves in a quandary. This article aims to shed light on the differences in agent commissions between unit trusts and life insurance in Malaysia.

To begin with, it is important to understand what agent commission is. Essentially, it is the fee that agents earn for selling financial products. This commission serves as the primary source of income for many agents, and it varies significantly between different types of financial products.

In the context of unit trusts, the agent commission is typically a percentage of the amount invested by the client. This percentage can range from 1% to 3%, depending on the specific unit trust and the policies of the fund management company. The commission is usually paid upfront when the investment is made, and it is deducted directly from the investment amount. Therefore, if a client invests RM10,000 in a unit trust with a 3% commission rate, the agent would earn RM300, and the remaining RM9,700 would be invested in the unit trust.

Investing in a unit trust involves a one-time commission of 5.5%. Once the initial investment is made, the investor benefits from the potential growth of the Net Asset Value (NAV) of the unit trust over a period of 30 years. This long-term investment strategy not only allows the investor to accumulate wealth but also offers financial benefits to the agent who manages the investment.

The agent receives career benefit credits that are added to their monthly income as a form of passive income. These credits are tied to the growth of the NAV, meaning the more the investment grows, the more the agent earns in passive income. This creates an incentive for the agent to manage the investment effectively and ensure its growth over the years.

The career benefits start being paid out after six months from the initial investment. This means that the agent begins to see the financial rewards of their efforts relatively soon after the investment is made. As long as the investor does not redeem their investment, these career benefits will continue to contribute to the agent’s monthly income, providing a steady stream of passive income.

This system not only benefits the investor, who sees their investment grow over time, but also the agent, who is rewarded for their work in managing the investment. It creates a mutually beneficial relationship where both parties have a vested interest in the success and longevity of the investment. Therefore, maintaining the investment without redemption ensures continuous financial growth for the investor and consistent passive income for the agent.

Passive income for unit trust agent

Let’s break down the calculation for the passive income based on the given NAV of 100 million:

1. First 3 million at 0.21%

(3,000,000 \times 0.21\% = 6,300

2. Next 3 million at 0.22%

3. Next 3 million at 0.23%

(3,000,000 \times 0.23\% = 6,900

4. Next 3 million at 0.24%

(3,000,000 \times 0.24\% = 7,200

5. Remaining balance (88 million) at 0.25%

(88,000,000 \times 0.25\% = 220,000

Now, add up all these amounts to get the total annual passive income:

(6,300 + 6,600 + 6,900 + 7,200 + 220,000 = 247,000

To find the monthly passive income, divide the annual passive income by 12:

(\frac{247,000}{12} \approx 20,583.33\)

So, the monthly passive income from an NAV of 100 million would be approximately RM 20,583.33

High commission no passive income

On the other hand, the commission structure for life insurance is somewhat more complex. Life insurance agents earn commission not only when the policy is initially sold but also on the policy’s annual renewals. The initial commission can be quite substantial, often ranging from 25% of the first year’s premium. For instance, if the first year’s premium for a life insurance policy is RM2,000, the agent could earn between RM500 as commission.

In addition to this, life insurance agents also earn renewal commissions for as long as the policy remains in force. These renewal commissions are typically much lower than the initial commission, often ranging from 5% to 10% of the annual premium. However, they provide a steady stream of income for agents over the long term.

It is also worth noting that the commission rates for life insurance are regulated by the Life Insurance Association of Malaysia (LIAM), which sets maximum limits on the commission that agents can earn. This is done to ensure that agents do not overcharge clients and to maintain a level playing field in the industry.

In conclusion, while both unit trusts and life insurance offer lucrative commission opportunities for agents, the structures of these commissions are markedly different. Unit trust commissions are simpler and more straightforward, being based on a percentage of the investment amount. Life insurance commissions, meanwhile, are more complex, involving both initial and renewal commissions, and are regulated by industry standards.

Understanding these differences is crucial for investors, as it can help them make more informed decisions about their investments. It can also help them negotiate better terms with their agents, ensuring that they get the best possible value for their money. After all, in the world of finance, knowledge is power.

A Deep Dive into Agent Commission: Unit Trust versus Life Insurance in the Malaysian Market. In the financial services industry, agent commission is a critical aspect that influences the decision-making process of both agents and clients. This is particularly true in Malaysia, where the market for unit trusts and life insurance is robust and competitive. Understanding the differences in agent commissions between these two financial products can provide valuable insights for both agents and potential investors.

Unit trusts and life insurance are two popular investment vehicles in Malaysia. Both offer unique benefits and cater to different financial needs and goals. However, the commission structures for agents selling these products are markedly different, which can significantly impact an agent’s income and a client’s investment decision.

Unit trusts, also known as mutual funds, pool money from multiple investors to invest in a diversified portfolio of assets. The agent’s commission for selling unit trusts in Malaysia is typically based on a percentage of the amount invested by the client. This percentage can range from 1% to 3%, depending on the fund and the investment amount. The commission is usually paid upfront when the client invests. However, some fund management companies also offer trail commission, a recurring annual fee based on the value of the client’s investment, which provides a steady income stream for agents.

No passive income for Life insurance agent

On the other hand, life insurance is a long-term contract between an insurer and a policyholder, where the insurer promises to pay a designated beneficiary a sum of money upon the death of the insured person. In Malaysia, the commission for life insurance agents is more complex and can be significantly higher than that of unit trusts. The commission is typically a percentage of the policy’s premium and is paid over the policy’s term. The percentage can be as high as 25% in the first year, decreasing to around 5% to 10% in subsequent years. This structure encourages agents to sell more policies and retain clients for a longer period.

High commission no passive income

While the potential for higher commissions may make life insurance seem more attractive to agents, it’s important to note that selling life insurance requires a higher level of expertise and commitment. Agents need to understand the complexities of life insurance policies and be able to explain them clearly to clients. They also need to provide ongoing service and support to their clients, which can be time-consuming.

From a client’s perspective, the commission structure can also influence their investment decision. Clients may perceive that agents selling life insurance are more motivated by the high commissions than their best interests. This perception can lead to mistrust and reluctance to invest. On the other hand, the lower commissions for unit trusts may make these investments seem less costly and more attractive to clients.

In conclusion, the agent commission structure for unit trusts and life insurance in Malaysia is significantly different, with life insurance offering potentially higher commissions. However, this comes with increased responsibilities and potential challenges in building trust with clients. As such, agents need to carefully consider these factors when choosing which financial products to sell. Similarly, clients need to understand how agent commissions can influence their investment decisions and seek advice from trusted financial advisors.