How to live in paradise with endless money during covid19 How to find money to feed oneself and family during the pandemic outbreak of Covid19? The Covid19 is never before catastrophe to the world economy. The world standstill, the factory has closed thus causing the immobility of humans on a large scale. The government […]

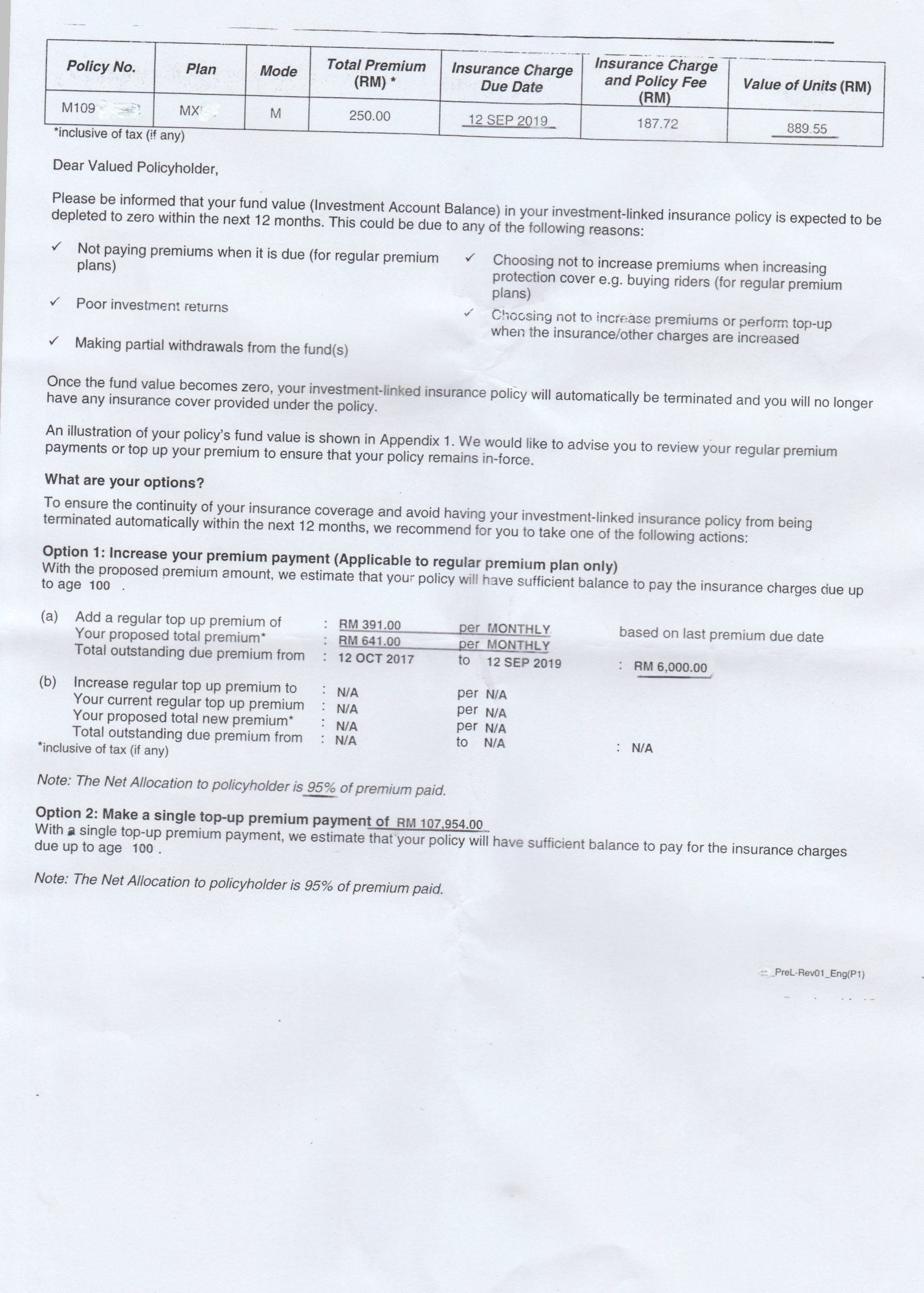

Be alert not legally scam by linked insurance now

Be alert not legally scam by linked insurance now Nowadays, often you read or hear or see in social media been scam by the unscrupulous scammer. But, have you ever hear you are been legally scam by the insurance company. Why did I say that? Because I am the victim, moreover, ironically like added salt […]