Claim for Flood Damage for a property The recent Australian big flood destroyed thousands of homes and property like cars and livestock. Had you prepared for the flood claim on your property yet? Now, it is time to study your policy closely on the clause on a flood damage claim. Call your agent for advice […]

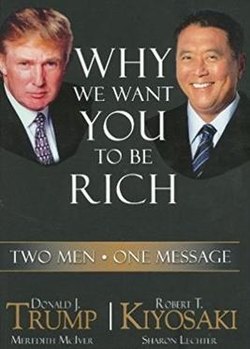

How to Live in Paradise with Cash Endlessly

How to Live in Paradise with Cash Endlessly Extraordinarily insane, you would say the tile. In the first place, is it attainable? Had you ever read the book” The millionaires next door”. That super-rich lives in a frugal lifestyle sleep with a pile of cash sleeping on the pillow. In fact, they are living in […]

How to Leverage Time for Passive Income while Working?

Leverage Time for Passive Income while Working. So, now, any passive income ideas. Does anyone know?. Uniquely, the rule of 5 implies that 5% of the fifth billionaires control 95% of the world asset today. It fact, they have multi-sources pf passive income, Similarly, the balance of 95% world population owned a miserable 5% […]