How to Live in Paradise with Cash Endlessly

Extraordinarily insane, you would say the tile. In the first place, is it attainable? Had you ever read the book” The millionaires next door”. That super-rich lives in a frugal lifestyle sleep with a pile of cash sleeping on the pillow. In fact, they are living in Paradise with plenty of leisure time and traveling around the world, and of course, Cash. Indeed, the cash is King, with a tap of flow out cash endlessly. Let us unwrap the secret, there is no concealment.

As can be seen, by yourself, what are you doing in the morning from Monday to Friday? Sadly, you would answer,” prepare to beat the traffic jam or stuff in the packed sardine train or bus compartment.” Is that what you have in the thought and learned in school or university? Anyway, we cannot blame you, but our education system.

“Oh, my dear, study hard and obtain a flying color result and find a good remuneration job when you are graduated” Does this statement ring a bell to you. ” Countless time” you reply.

Now, raise the question,” Do you want to live in Paradise with cash endlessly?” “Yes,” even the dummy would reply to you.

But, why are you still live in fortnight paychecks? You graduated with an Honors degree from an ivy varsity. Do you that Marketing is the highest reward career. In a nutshell, even corporate CEO rise from the Marketing Department.

Fear to talk to a stranger: Do you fear to ask a stranger when you cannot locate a place?

Job Security: Do your letter of appointment stated you are hired for your whole life?

Promotion: You determine your fast promotion.

Now, comes the serious question:-” what is a career”

Be own entrepreneur/Consultant

In the first place, had you ever think of setting up your own business? What is the initial capital outlay? Astonishing, it requires a vast sum at the beginning. Moreover, not to mention the numerous licenses need to apply. Time-consuming, isn’t it so? Furthermore, you need to burn some of your saved money vanishing into the thin with a few sales. Sadly to say, it cannot even cover the overhead expenses like maintenance fee, electricity, water, and wages.

Overall, you need a few years to have a breakeven that is speaking from own experience ventured into a logistic company over a decade. I did marketing followed my own lorry driver canvass from shop to factories. Helped my driver to load the cargo to gain 1st hand experience. Not to mention the working under the sultry hot sun with fast exhaustion, but also cultivated my determination and persistence in life.

“You are stupid!” “Why don’t you operate a retail shop? No sunburn and enjoy the cool breeze of the air-conditioned. Yes, this is true. I totally agreed with you.

However, do you think the customer will flock to your shop daily for a transaction? Are you an established brand store with a lot of cash flow? How long can you compete with them? Not only that, can you compete with an online store with a rocket bottom set up fee with the one-man show? Likewise, in the same manner, people prefer to buy online with good delivery at their door, avoid traffic jams and prickly heat.

But not to dismay, there is always a silver lining in the gloomy sky.

Why Marketing Industry – live in Paradise with cash

I closed the logistics company after ran over a decade. Of course, I did make a little fortune. The scarcity of honest and industrious driver couples with the raining toll cost. Moreover, it requires high maintenance of a fleet of Lorries, in addition to the stress in the wee hours of the morning.

“Boss, the lorry breaks down with a full load of cargo, please sent a spare lorry to transport the said to the port.” The driver’s call really drives me to nut interrupt my sleep.

Beside, ran a transport, I also did Corporative Marketing for a general insurer. I quitted the 9-5 job as a Business Development Manager after 5 years becomes a full-time marketer in the 1998 Asian Finance Crisis. Alas, I find out I could not recruit agents like the Life insurance industry. How sad!

I called and met my mutual fund consultant, without any question, I signed up with him in late November 2002, and sat he written examination in Dec 2002. A month later became a mutual fund consultant. The rest is history.

Flexible working Hour

I kissed the traffic jam forever goodbye. Gone are days earlier morning rush to beat the congestion hour. Moreover, most of the customers would busy with daily work with a tea break at 10 am. I plan my appointment schedule. I closed sell easily at the lunch hour or tea break, very informal style, In the case of marine or fire mega risk, I require to do with a quotation and a few follow-ups.

Financial Independent

In fact, most of us are a moron in finance aspects. Financial savvy is indeed lacking among the elite group of society like those professionals. Engineer, professor, lawyer and underwriter like me included. I was a dummy too. After closing a marine case, I dashed to purchase a Canon Camera with lens and accessories amounting to more than RM50k, and some spare went for a holiday for shooting. Not to mention the Sony video tagged along.

In the end, mutual or unit trust thought me never purchased a book written by a finance professor, it is all theory. In the same fashion, if they are so knowledgeable, why they still teach in the U. Don’t ever listen to their noble excuses “Because I like to impart knowledge”. Absolutely B.S! In fact, a mountain of mortgage debt to cater for even they retire.

So, what book you recommend to read? Look for a book by those authors who once broke and later raising up millionaires. Like books such as written by Robert Kiyosaki and Donald Trump “Why we want you to be rich”. Equally important is the books written by Tony Robbins for positive energy vibration to your brain. It transforms you from a pessimist to optimist.

Then, again, don’t venture into the share market unless you mastering the hedge fund. Your individual capital is a tiny drop of water in the ocean in comparison with the hedge fund player. Be wise; don’t fight with a sword with a bomb.

Types of Income

Frankly speaking, you toil hard for your company. How many types of income you entitled. Namely, you reward with a monthly salary, bonus, and allowance incentives like shift, meal, and transport. But in mutual, they are 8 kinds of income namely, commission, override commission, break bonus, parallel bonus, group bonus, year-end bonus, group overriding, and lastly the most important monthly career benefits. Uniquely, the career benefit only avails in the mutual trust industry, absence in life insurance. So, they are 8 types of income stream flow in your pocket.

Equally important is the career benefit, it flows cash endlessly even though zero sales for the whole year, so you can live in paradise. Which sectors pay you that? Just like the Cantonese saying “Where do you find edible frog jumping in the street?”

Publicity Announcement for Recognition of hard work

Ask yourself this question, “if you achieve your target” What your company rewarded you. “Just a trophy”

But, here in the paradise living, they recognized your effort with incentive free oversea trip and publicized in the local daily newspaper with name and your image. Practically, you bring nothing except your body and personal items, the rest are catering for you with five-star services with ample delicious food. Of course, they dedicated travel guides to plan your smooth seamless tour. Plenty of leisure shopping time, you can shop like a fifth rich tycoon without the blinking of your eyelid. In fact, I added a few kilos in my belly in such a trip.

Loan Subsidies

To say nothing of, do you establishment gives loan subsidies with no string attached the tenure of working period. “Fat Hope, you can fly kite”.

In paradise living, you are giving 6.5% and 5% respectively for housing and car loan. Range from Rm100K the minimum to Maximum of RM 1million for the house. Depending on your ranking Agent supervisor maximum allows it is RM200k. Agent Manager RM500K and lastly the Group Agency Manager of RM 1million for the house.

The Car subsidy gives RM50K for supervisor, RM100K for manager and RM150k for Group Agency manager.

With the surplus cash, are you not living the paradise for up 70 years of age for a house and 10-year loan tenure for a car?

Noble Job

When you work for other people, you have enriched your owner getting rich, while you are getting poorer. Permanently disablement or bedridden, terminated is the only option for you. What a tragedy, your hard work in the past not appreciated. Is that so-called job security for life?

In paradise with cash flow endlessly, the public needs your guidance for financial savvy and freedom financially. Depend solely on active income is not financial freedom. Again, I narrated my own experience, I almost in bankrupt stages when I joined the industry with ¼ of million in debts. Never trust or greedy. Saves a little and invest in the heyday. Spend all the hard earn commission for the endless desire to want. That was the reason for my downfall.

Through unit trust and coupled with the practice of positive energy vibration learned from Master Tony Robbins. 4 summers lapsed; I purchased a house in cash.

Likewise, in the same manner, I guide one of the investors instead of saving in Fixed Deposit but invested in the unit trust. 8 years later, he purchased a condominium in cash at Johor Bahru. Not to mention, there is a surplus equally the same amount of the condominium price, isn’t it a noble job.

Training & Development

No matter, how skillful in your job, you need constant training. Otherwise, you are obsolete like the Kodak Film. Equally important in the mutual fund industry, always update the knowledge from the technical aspects to human touch. As we can see from the smartphone, it keeps on rolling out a new update version of new generation gadgets. Not to forget the digital apps application download from the company.

Invite the fund manager to share and update information, not only to a consultant but also to the unitholder. The company also paid generously to prominent outside speakers to spur the motivation in human touch and relation to consultants? What else could we ask for?

Be it a workshop or seminar, with full participation the consultant. Indeed, a joyful session.

Legacy

If you are the department upon retirement, can you groom your child to take your position? Absolutely No, unless you work for your father company or you own, am I right?

But in this sector, you are grooming your child to take over your position even with a high school certificate for Group Agency Manager.

Unfortunately, if you are unable to groom your kid in time, but you’re next of kin would allow enjoying for cash flow endlessly for the next 5 years based on Nav. In the same way, will your boss treat you this way?

Build up Net asset value for Passive Income

Net asset value is the meaning. When your unit holder invests in a mutual fund, over the year, the accumulation unit of growth, despite the price is down.

Let us say the initial investment of RM100K with 25 cents per unit ignored the sales charge here which is insignificant over a period of 10 years. Thus, 400K units cost with an average price of 25 cents per unit. With distribution payout, initially, he 400K units accumulate 4 million units over 10 years period. Currently, the fear assault of the Covid-19, the price drop to 10 cents per unit. Unlike in the stock, unit trust, the longer you keep, the capital grows. Thus 4million unit x 10 = RM400 000.00. From 6 months later, you are enjoying the career benefit of monthly passive income endlessly without fail.

Gradually, your net asset values grow tremendously if the unitholder leaves for 30 years and later on passed it their children or grandchildren without any unnecessary redemption.

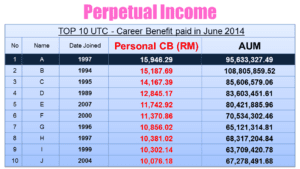

No surprise, some top leaders earning more than RM100k from the career benefit of passive income. Indeed they are life on Paradise with cash flow endlessly.

Finally, could you buy your house in cash like those wealthy guys? Action speaks louder than a word, please call or WhatApps me now as shown in the video, so that you can live in paradise in cash endlessly.

Call or Whatapps Now + 60 013-7839857 or email me at jaminhappy@gmail.com

[…] you want to accept the job offer for a Marketing or Sale Executive in our […]

thank for reading.