Claim for Flood Damage for a property The recent Australian big flood destroyed thousands of homes and property like cars and livestock. Had you prepared for the flood claim on your property yet? Now, it is time to study your policy closely on the clause on a flood damage claim. Call your agent for advice […]

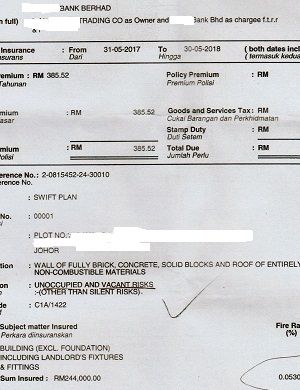

Who pays the Bank’s mistakes on fire insurance?

Who pays the bank’s mistakes on fire insurance? Do you have fire insurance on your home? If a fire occurs, who pays the bank’s mistakes on fire insurance? Generally speaking, the working class will always dream to have a roof over their heads. In order to archive the goal, they toil hard from dawn to […]

How to Buy the Right Home Insurance and Typhoon Damage?

How to buy the right home insurance and typhoon damage? Typhoon Hagibis – which means “speed” in the Philippine language, Tagalog – was the most powerful typhoon to hit Japan in six decades. In fact due to the fast climate change over a few decades, mainly, clear the jungle for human activities. Human […]

Renew Road Tax Online, Avoid Traffic Jam, Parking & Queue

Renew Road Tax Online, Avoid Traffic Jam, Parking & Queue Nowadays, it is a fin-tech world, a click to renew road tax online, avoid the traffic jam, queue, and parking. With the implementation of Myeg is the Malaysia e-government services provider, allowing us allows us to transact with various government agencies online. It is a […]