Why Life Insurance, Prospect Avoid you like Plague?

Why buy Life Insurance, Prospect Avoid you like Plague at all cost. Regrettably, the Malaysian life insurance penetration is merely 56% of the total population in 2016. It implied that the balance 44% of the citizen have no life insurance. Or it could be ignorance or let fate decide your destiny. The worst scenario could be an inborn defect, the underwriter rejects their application. Why we have such a pathetic scenario? Blame the pyramid, the insurer, agent and the assured. Sadly to say, all the three bear their share of responsibility.

Not only, had no insurance but also sometimes the insured have the sum insured purchased inadequately. Usually, the average amount is about RM100, 000.00 to RM150, 000.00. With this meager sum, can it feed your beloved one or dependent for 5 or 10 years if one day you forget to return home? In fact, the adequately amount varied between urban or rural living plus also the working spouse or children. Nevertheless, the meager sum insured is hardly enough to last for a year living in the city. Like rubbing salt to the wound, can we survive with 2 or 3 kids in toll for a single parent?

Why Buy Life Insurance.

Is it the responsibility of a parent to take care of the children’s welfare when one demises? Very often, we heard the sobbing story of cool-blooded landlord eradicated single parents out from their rental home. Subsequently, like adding fuel to fire, the bank publicly auctions off the roof over their head if you default for 6 months payment. In true fact, the bank often shuts off the umbrella when you don’t have life insurance or MRTA to cover the loan tenure.

The Kid suffer without life insurance left by parent

By the same token, the innocent child is also the victim when one parent remarried. Stepparent often preys on the defenseless kid. Recently, a newspaper reported rape, physically tortured with multiple cut and bruises and old wounds over the emaciated kid body. The police rescued a retarded boy from the evil mother. The shocking reason given, chained the boy like a dog in a small cage preventing him from strolled out. Can your soul be rest in peace if someone does to your child? Unless you are heartless, no human can bear to see the suffering of abusive and inhumane tortured. Even the beast-like tiger does not devour on the offspring.

Why Life Insurance, Prospect Avoid you like Plague?

Expensive to have life insurance policy

In the ever-burgeoning budget of a newly married couple with a kid, indeed life insurance is a luxury item. Coupling with the car loan, parking, fuel and maintenance, insurance and road tax eat up a chunk of their salary each month. Moreover, there is the student loan, housing repayment, utility bill, an emergency fund like a kid doctor bill and a love gift to aged parents. Luckily, if they could have a break-even or a blessing to have a tiny disposal income left for saving. With a tight budget, any extra is beyond their mean and classified as a “luxurious” item like buying life insurance.

Get the Qualified Agent

Needless to say, it is advisable for such a young family to have affordable term life insurance. In fact, it cost merely a daily high tea at a local café. Contradict to the agent not to buy term but investment or whole life policy. If the agent insists on all sorts of reasons, it is time to kiss the agent forever goodbye. Why? As a matter of fact, the agent only bothers their fat commission, not your pocket. What is the chance of a lapsed policy in the due course? Thus the result is about 60%.

In the same manner, if you could afford, what is your opinion you prefer pricey life insurance compared with a bedridden spouse or kid at home to maintain? Death is an instant relief, but the loved ones have undergone lifelong grief. So why turn yourself an irresponsible parent? You could be curse subsequently by those still alive struggling to meet day end need?

I lead a healthy lifestyle, No Need Life Insurance.

Nowadays, insurance agent always complaint is difficult to close a sale with the young and active people. The yuppie leads a healthy lifestyle to visit the gym 5 days a week after work. Likewise, they eat the meal moderately due to health and the utmost important tight budget. How far is that true? We puzzle? Eat junk food like instant noodles with enhanced favor, fry egg and soft drink instead of mineral water or fruit juice? Surprisingly, the diabetics and hypertension suffer gradually knocking at their door.

Therefore, closely examined, the Malaysian demographic depicted young suffer from 30+, which was unknown in the last century. Honestly speaking, how many Malaysians have their yearly completed medical checkup? Toast off to you, if you have a clean report, otherwise, you are an insurable or substandard risk with premium loading.

Why Life Insurance, Prospect Avoid you like Plague?

Life Insurance Cover for Money Printing Machine

An unpredictable human being, in order to understand insurance, might take ages. They insured their movable assets like an automobile, exclusive motorcycle, extensive renovation home, camera, and household contents.

Surprisingly, they insured even pets for fury animals including the kernel, but no insurance for themselves. Rampantly road accidents and armed robbery daily affair, they often pray hard nothing would befall on them. Moreover, no one can predict when you are imminently sick or bedridden or walk on the clutches. Yet, there is no insurance to cover for the machine that prints money for you, that is your body. Gradually, overuse due to wear and tear a machinery breakdown; likewise, it is the same for your body. Consequently, a fatality occurs or lying motionlessly on the hospital bed.

Negative Perceptions

Crowded coffee kiosk, two middle-aged customers sat in between a young man, an insurance agent.

“I lament you not buy any insurance as my neighbor’s son hospitalization for a week in a private hospital, the insurer denied his claim”

“Why” another probed further.

“I do not know the reason for the rejection, initially the agent helped to claim, eventually the agent also unreachable “

“Yes, truly say, the agent and the insurer are the legal license conmen, promise you the sky, finally you get a barren hope.”

“Sorry, young man, I need to consult my spouse before making the decision from buying your investment-linked proposal” Another elderly prospect consoled the dynamic agent.

“Yes, it is alright to reconsider about it, please don’t hesitate to call me for any doubt clarifications” the agent replies politely.

Thus one rejected claim would eventually rumor spreading fast like wildfire.

The truth reveals

Occasionally, the half-baked agent would request the assured to sign on the dotted line without filling the medical history. In order to get prompt approval, the agent ticked all NO in the column even though assured mentioned has hypertension and on long-term medication. Whose fault? It is the Assured himself as he does not know anything when he blindly signed the dotted line on the proposal form. The former kleptocrat Prime Minister Najib Razak is a shining example.

Assured’s moral hazard

I did help to claim a case rejected by the insurer. Finally, to my dismay, I obtained a hospital report that assured did a kidney stone removal in a government hospital. When asked by the agent any operation done in the past. He negatively answered NO. Consequently, the insurer denied its liability for his claim on kidney dialysis.

Another case on hypertension question, nevertheless, assured answered negatively despite the fact of having daily oral medication. Eventually, the claim often denied by the insurer when a claim on stroke or kidney failure on the later stage.

Why Life Insurance, Prospect Avoid you like Plague?

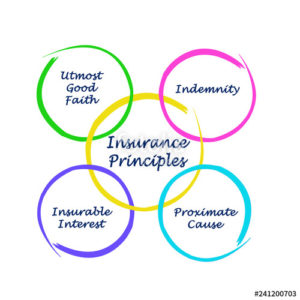

Utmost good faith on Life Insurance

Utmost good faith is one of 4 principles governed by the rule of the insurance law. It is a legal binding between the assured and insurer when entered into an insurance contract. The assured disclose all the relevant material facts to the prudent underwriter in determining to reject or accept the offer. Whether the assured know or unaware of the health condition, you need to disclose to the insurer. So, sincere advice bares all the facts to the insurer to avoid future disputes on claim matter.

No Dependent

Generally speaking, couldn’t care less is the altitude of most of the y generation. Chase after the latest trendy iPhone gadget every six months. Moreover, priority on holiday, pay later for the credit card payment. Buy Life insurance? Why need it, I have no dependent is a tangentially reply? Single with no string attached, without any family commitment, no parent, no sibling, living on own world, why care! Having said that, what about your final funeral expense consequently let the government take care of burial, or leave the corpse to decay on the road or hospital? Perhaps, perform a unique Tibetan “sky burial” let the eagle devour on your corpse.

Notwithstanding, if you have a grey hair retired parent, it isn’t a double pain for them. Losing one child, and the final expenses, ritual prayer, and burial ground to pay for? Unfortunately, the doctor confirmed you as total permanent disability, aren’t a pain in the neck hiring a nurse or long-term nursing for you. Conversely, put you in the nursing home, who pays for maintained expenses?

NO MONEY

Why Life Insurance, Prospect Avoid you like Plague?

No money is just a lame excuse to put off for the newbie’s advisor. Regardless single or a young married couple is a norm form of getting rid of intermediary. Or postponed, the chance is they procrastinate for a few more years. Luckily, the body has no red alerts for silence sickness. Meet a car accident, then you want to cover your car for a comprehensive term, do you think insurance company run on charity and accept your offer. Blatantly, the insurer you turn down your offer. But in the true fact, the majority of the insured have this kind of weird idea. I have stumbled across a few incidents like this before during my 25 years in the insurance industry. Does the insurer run on charity? Please answer.

Time and Tide wait for no man

Overall, we aged with the erosion of time, coupling with consumption of highly toxin junk food daily intakes. No wonder primary school going kid had undergone kidney dialysis at the public hospital. A normal phenomenon is today’s society with a stressful lifestyle chasing after material gains. The insurance premium gradually rises accordingly to your age. Not only the higher premium pay but also lower the sum insured if we compared a lad aged 20 and another 30 years old adult. As we age, we are prone to illness due to our sluggish immune system.

In brief, please buy insurance when you are in your youthful vigorous year to save cheaper premiums with a higher sum insured. You can even apply for term insurance for a 10 years gap band.

Jargon wording with length sentence

How many lawyers and layman can you consult and understand and interpreting sentence by sentence in the insurance policy? Nobody trained in all fields; therefore no one is an all-rounder in this world. Diligently consult your agent or even bring the policy to the insurer for a full explanation. Closely examine the following point, you would face difficulty in handle a claim in the near future.

Exclusion Clause

In this column all the sickness or any circumstances relevant contradicted to the policy, the insurer would deny its liability. For instance, commit suicide within certain years or claim on pre-existing illness know to the insured. Please highlight to the assured when delivery the policy for acknowledgment of the receiving the policy. Do not conceal the fact, it is better to avoid short-term pain rather finger pointed out how irresponsibility of the consultant.

Inception Date

The policy enforced with the date clearly printed out and the expired date of the policy. Commencing date is of utmost importance in the case of medical or 36 critical dreaded disease claims. Never overlook it. Frequently, assured would hospitalize for an illness, and bravely ignorance the waiting period. Subsequently, no entertainment of the claim, the assured would spread the rumor that insurer selling a scam policy, even though the default lies with assured. Sabotage the agent, branded you feckless advisor, and tarnished your name.

The schedule

In this schedule, your name and identity card number should spell accordingly to your national identity card. Correct the error immediately should you spot a mistake. Thereby, the insurer has no leeway to deny your future claim. Do not give the underwriter a chance for your consumer’s rightfulness claim.

Highlight the type of coverage, whole life, endowment, term or investment link or purely medical card policy. You need to aware of the total permanent disability, 36 critical illnesses, and waiver of premium due to dreaded disease or the payor. Any hospitalization benefit per day, woman disease and pregnancy admission specified according to your signed proposal form. Scan any deviation, informed the agent in a written form and ensure the insurer to pass endorsement accordingly. Finally, you made a note of the sum insured in the schedule.

Stated policy Number in the claim form

Stated the policy number in the policy for convenient correspondence with the insurer claim, when ledge a claim in the future or an endorsement. How much premium you have to pay? Assured need to warn adjusted premium during the duration the whole validity of the cover, not to forget if the medical card guarantee renewal clearly stated.

Why splurge an exotic meal under the candlelight dinner or exorbitant family oversea excursion. Or perhaps the endless chasing the ever change the latest gadget every six months. Why not paused and think for your loved one when one day you lose your way home? Get a policy coverage that ensures all the financial constraints would not befall the ongoing family.

Your Thoughts

As usual, I would love to hear any thoughts or questions that you have in the comments section below.

https://alidropship.com/?via=11978&campaign=happyjamin.com

David Kinder There’s a file in the files section called “Why life agents have a poor image.” Might be worth reading.

https://lookaside.fbsbx.com/…/Why%20Life%20Agents…