Be alert not legally scam by linked insurance now

Nowadays, often you read or hear or see in social media been scam by the unscrupulous scammer. But, have you ever hear you are been legally scam by the insurance company. Why did I say that? Because I am the victim, moreover, ironically like added salt to my wound as I was an insurance agent myself.

Not blowing my own trumpet having passed the Chartered Insurance Institute with Distinction on my final marine claim and underwriting. I was an associated member of AAII, AMII, and CII after passed all my 6 objective papers and 3 hours written 13 subject papers. Also, I am a Marine adjuster licensed by Bank Negara. Having said that, do you think I would be much better off than people walking on the street to understand the policy contents? Likewise, would you agree I can interpret much better than some qualified life insurance agents? I joined full-time corporative Marketing personnel in a conglomerate public listed general insurance establishment in 1994. Prior to this, I handled mainly with Marine cargo insurance in 1981.

But the truth speaks for itself; I too fall as a victim by the legal scam of the insurance company.

Be alert not legally scammed by Insurance

“You are stupid, why you don’t consult your immediate up line” sarcastically said.

“Well, my immediate only an STPM holder, furthermore, his up line merely an M.C.E qualification”

“Because, you are too ego seek advice from them” Both of my up lines are from East Malaysia, at the time there is no WhatApps. Now, I hope you understand my situation.

“You don’t go for training” You are wrong. I attended and enjoyed the sharing training with zest with a lot of questions. In fact, I arrived earlier before the training with a notebook and pen. I scrapped the entire note as if I attended a lecturer or tutorial.

How insurance can scam you

I joined the life insurance in 2005 after my relative knew my predicament of Rm250K overdraft loan with a local bank. Eagerly I signed up and sat for the life and investment-linked examination. Nothing too proud of, of course, I passed with a distinction with less than an hour in the examination, In late December 2004, the 3 hours objective paper. Mind you, we still used a 2B pencil to shade the correct answer. After that, we waited for weeks for the results from the insurance company that we had earlier signed as an insurance agent.

Meanwhile, waiting for the result, I start to read a book on a life insurance policy. But to my astonished, in fact, the most popular product is the investment-linked insurance, besides the endowment policy. Why no term insurance? Please ask the insurance company, but the agent point of view, 10% commission not attractive enough to put the hard work. On top of that, it is a cheap premium without any saving in nature.

Anyone can answer me “what is the purpose of life insurance” Protection. Isn’t correct? If you say “saving” is ill-informed by the insurance agent. Unit trust or mutual fund or even bond gives a better return than the fixed deposit. Obviously, it is not the investment-linked product that you have purchased from a life insurance company.

Be alert why insurance can scam policyholder

All in all, when you approach by an insurance agent for life policy, do you really know what product suit your criteria? Even with the fact-finding and your financial standing. You are pretty sure the insurance would propose 3 in one policy to you. Namely, the only choice left for you is the investment-linked 36 critical illnesses. And of course not forget the utmost important medical card and waiver of premium rider that you need the most. Is that a level term insurance regardless of the entry age?

Besides the 110% commission payable to an insurance agent, how much left for the investment compared with 5.5% charges for unit trust. Even cheaper if you parked your hard-earned money in the 3.75% e investment and 1% for bond charges. Frankly speaking, even a primary school student would able to answer which is more premium in comparison.

Be alert not legally scam by linked insurance now

Non-Transparency Investment-linked Insurance

Had your ever cross your mind the reason why insurer promoted fiercely. It can legally con the insured, am I not wrong to say that. Faithfully, you pay the premium via credit or debit card without pay every month. The dear insured had ever received a small booklet stating the percentage of the premium. Which sector of the industry, for instance, telecommunications, consumer product, finance, technology, energy? Also, is it invested locally or abroad? Which country with the breakdown in percentage invested, for example, Japan, USA, China, regional or the Asia Pacific? What about the management fee and trustee fee per year?

Affirmative you would say “NO” Truly; the insurance company is no transparent toward the insured. This is legally scamming the insured, wouldn’t you agree? Year-end, you would receive a copy of the mail stated the balance unit and the net asset value. If the unit trust or mutual company can deliver a brochure with details of the percentage of major companies that had invested, likewise, why can’t the insurance do the same? Thus, it lacks transparency to the insured.

How insurance scam policyholder

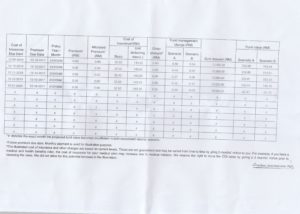

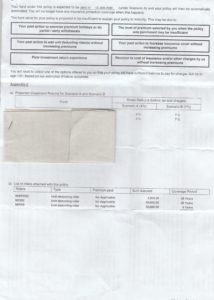

After all, you ask me where is evidence. Hereby, let me illustrated you with proof to you with the actual scenario. Of course, I have deleted the insurer name for the view of the general public, and also, not to tarnish the reputation of the insurer.

I signed up for the policy in 2010, to cover part of my renovation housing loan of Rm250k for the tenure of 18 years. Why RM30K sum insured, not the RM250k as I have other life policies? I did the auto-debit from my visa card monthly of RM250.00. Why not is the mortgage reducing loan or mortgage reducing term loan? Please refer to my website yesnoclaim.com. On top of that, the training facilitator always emphasis on the investment-linked product for saving purpose. How far it true now, let use your acumen to be my judge?

After paying RM21 500.00 due to the “premium holiday”, I stop the payment for a while. Moreover, when I purchased a programmer from the USA for e-Commerce at home, the counter clones my visa credit card of US$69.00 after a week. I alert the bank to cancel and replace me with a fresh visa credit card. As I engrossed to master the new subject, I forgot to inform the insurer. But, nevertheless, I only blamed my forgetfulness and moreover thinking of premium holiday.

Be alert not legally scam by linked insurance now

Gentle warming reminder from insurance

To my dismay, a 5 pages letter arrived at my letterbox. The insurance stated that charge due date on 12 Sept 2019 with only a value of RM889.55. Given the option 1 of paying up with addition a regular top-up of 391.00/month based on last premium due date. Your proposed total premium of RM641.00/month, why the word you proposed?

For your information, in the contract of insurance law, you as an insured offer your premium as a consideration to the insurance company. It depends on the insurer to accept or reject your offer.

Or perhaps, financial sound, I could pay up the outstanding premium of Rm6K from the premium holiday commenced from 12 Oct 2017 to 12 Sept 2019.

Moreover, the investment amount is only 95% of your premium paid. Despite the fact, you are aware the agent commission stops at year 6. Why not the full amount paid? The insurance hijacked your 5% premium payable, would not agree with me?

The option 2, absolutely insane, makes a single top-up premium of RM 107,954.00. If you can pay up such a big chunk of money, would you pay for it? Just pay a paper contract of promise? Again, have you considered your other opportunity cost for it?

Also, another option 3 is to increase the basic premium or reduced sum insured or removed some riders. Thus, by doing so, you pay lesser premiums to reduce your burden?

Indeed, I am at the crossroad, could anyone lent me your hand to solve this crisis.

The shocking truth of insurance scam

I left penniless on 12 Jan 2020 if I do nothing of it. How sad! After paid Rm21500.00, you get nothing in return? Is that called saving by investment-linked product? You tell me. Legal scam by the insurer is the true fact. Protection and coverage you say for almost a decade? My feet!

Further, the fund return is a projection return range from 4% to 7%. It sounds so good to be true, isn’t it? Anyway, it is still a projection, what is the fund manager doing? Sleep on the job. Of course, you could predict the future return. But the past record was a historical figure, but it did not reflect the good return here.

Illustrations

Let me illustrated here. Let us take Rm125.00 monthly top up with 4% interest per annum, After 7 years you would get Rm12 267.09. Please bear in mind I only use Rm125.00 (i.e. 50% for the whole 7 years) of the premium paid to derive this figure. How could we stomach this Rm899.55? Don’t tell me is a saving principle element here. OR scam! Is it fair to the policyholder, where shall we seek justice?

Without further ado, let us dive deeper, why I took 50% of the premium paid for the investment. There is a higher premium for the age entry, the younger, lesser premium charge, with a better-off return also bigger sum insured. The older you are, you pay more premiums, less coverage and less return in a shorter span of time. That is the main reason, it is better to have insurance coverage at a younger age of entry.

Insurance coverage Scam Be alert

Additionally, it covers another 4 years for my total permanent disablement. Isn’t it like rubbing salt to my wound? The termination covers stop at when you attain the age of 65. If you longer than a day, a mishap when you slip and fall and bedridden, no payment for the RM30k. Thus, you have to pray no accident befalls on you until you are 100 of age.

With a basic sum insured of RM30K for the life and 36 critical illnesses each respectively, thus gives a total sum insured of RM60K. If you die with the coverage period, you would receive RM60K by your next of kin. Of course in addition to some fund return still based on projection.

Ignored the earlier payment of RM21 500.00, let us take a single up premium payment of RM107,954.00, what is the opportunity cost of this amount in comparison with the sum insured of RM60K.

Assuming the lower return of 4% with a 39 years period as given by the insurance company fund manager and actuarial calculation, finally, you reward with a handsome better return by the insurance. It is a no brainy science; use the simple interest compound interest. In the end, you get a small fortune of RM498 355.17. The interest alone you gain to stand for RM 390 401.17 that is 78% and your principal of 22%.

Congratulations

You are a millionaire if we use 7% with the 39 years tenure and the same principle. Voila, the final reward is RM $1,510,796.84. Would you prefer the Rm1.5 million or the RM60K plus some uncertainty interest return?

The worst case of scamming scenario

Be alert not legally scam by linked insurance now

Please refer to the page, after paid-up faithfully for 7 years, it really made my heart boiling to the maximum on the last page stated the projection figures are for sales illustration only.

Conclusion: Be alert not legally scam by linked insurance now

Now, all things consider and in the final analysis, had you ever stumbled across life insurance under receivership? Certainly, for sure there is none. With is kind of peanut return, are we not a legal scam victim by the insurance.?

The investment-linked insurance designed by the actuarial for protection and saving elements. I reserve my comment. I really don’t know.

Is the insurance company really scammed the policyholder or taking us for a ride? By now, you know the sincere answer.

Wrapping here, my final word, please read and digest your policy within the 14 days grace period upon receiving from the agent. Please surrender the policy and seek a full refund with no question by the insurance company if you find out it is worthless a contract of insurance that not up to your satisfaction.

Lastly, I sincerely hope to get your valuable comment or feedback for me to improve and share with others to avoid future mistakes like I did.