Disappearance on fair Mount Belumut Fails to Deter Climbers Mount Belumut, with its rich flora and fauna, crystal-clear streams, and breathtaking sunrise views from the peak, remains a popular destination for hikers despite the eerie myths surrounding it. One of the most persistent stories is the mysterious disappearance of hikers, which has given rise […]

Guide to Climbing Gunung Lambak and Belumut

Guide to Climbing Gunung Lambak and Belumut Kluang, situated in the heart of Johor, Malaysia, is often a hidden gem for nature enthusiasts, particularly city dwellers seeking a refreshing escape from urban life. The town offers two popular trekking destinations: Gunung Lambak and Gunung Belumut. Each mountain provides a unique experience, blending adventure with […]

7 tips to overcome your workplace bully

7 tips to overcome your workplace bully It is part of the parcel of our life. Whether we confront or ignore it, it all depends on individual upbringing. Workplace bullying can cause significant stress, anxiety, depression, trauma, high blood pressure, gastrointestinal issues, etc. Here are the seven tips on how to overcome your workplace bully. […]

How to claim free to your homeowner flood insurance

How to claim free to your homeowner flood insurance? How to claim flood damage insurance for free? How to claim flood damages free of charge to our home insurance in December 2021 Selangor state flood of the century? Most Selangorians have been devastated by the state’s worst flood in decades. With the current high inflation […]

How to live in paradise with endless money during Covid19

How to live in paradise with endless money during covid19 How to find money to feed oneself and family during the pandemic outbreak of Covid19? The Covid19 is never before catastrophe to the world economy. The world standstill, the factory has closed thus causing the immobility of humans on a large scale. The government […]

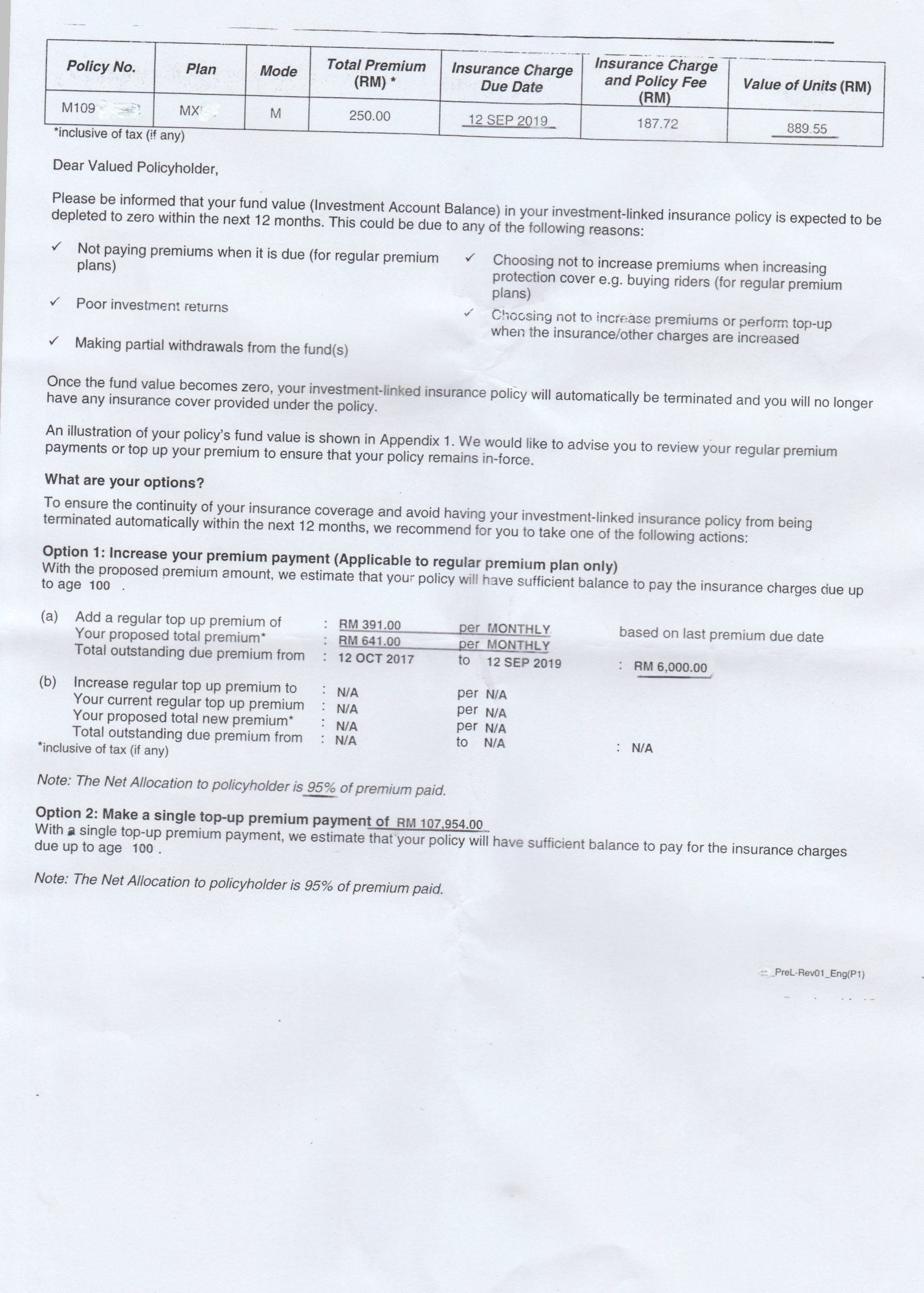

Be alert not legally scam by linked insurance now

Be alert not legally scam by linked insurance now Nowadays, often you read or hear or see in social media been scam by the unscrupulous scammer. But, have you ever hear you are been legally scam by the insurance company. Why did I say that? Because I am the victim, moreover, ironically like added salt […]

How to Live in Paradise with Cash Endlessly

How to Live in Paradise with Cash Endlessly Extraordinarily insane, you would say the tile. In the first place, is it attainable? Had you ever read the book” The millionaires next door”. That super-rich lives in a frugal lifestyle sleep with a pile of cash sleeping on the pillow. In fact, they are living in […]

Why Life Insurance, Prospect Avoid you like Plague?

Why Life Insurance, Prospect Avoid you like Plague? Why buy Life Insurance, Prospect Avoid you like Plague at all cost. Regrettably, the Malaysian life insurance penetration is merely 56% of the total population in 2016. It implied that the balance 44% of the citizen have no life insurance. Or it could be ignorance or let […]

One Nation Different States Tax Varies

One Nation Different States Tax Varies. A tales of two cities. I live in Johor state after returning from my oversea tertiary education. I work in Johor trough out my working life with a short stint in Singapore. After married, I often travel to Kuching, my wife hometown. There is where my culture shock began. Transport […]